Facts About Broker Mortgage Meaning Uncovered

Wiki Article

How Mortgage Broker Assistant Job Description can Save You Time, Stress, and Money.

Table of Contents8 Easy Facts About Mortgage Broker Vs Loan Officer DescribedExcitement About Mortgage Broker Vs Loan Officer3 Simple Techniques For Mortgage Broker MeaningSome Known Facts About Broker Mortgage Meaning.Mortgage Broker Average Salary for BeginnersNot known Factual Statements About Mortgage Broker Salary The Definitive Guide for Mortgage Broker Job DescriptionThe Best Strategy To Use For Mortgage Broker Assistant

It is very important to be diligent when hiring any type of expert, consisting of a home loan broker. Some brokers are driven only to close as lots of lendings as possible, therefore endangering solution and/or ethics to secure each bargain. A home loan broker will not have as much control over your loan as a huge financial institution that finances the financing in-house.One of the most complex components of the mortgage procedure can be determining all the various type of lending institutions that handle home mortgage as well as refinancing. There are straight lenders, retail loan providers, home mortgage brokers, profile loan providers, correspondent loan providers, wholesale lending institutions and others. Lots of debtors just head right into the process and also try to find what seem practical terms without fretting about what sort of lending institution they're handling.

Mortgage Broker Salary - Questions

Descriptions of several of the primary types are provided below. These are not always equally unique - there is a reasonable amount of overlap among the numerous categories. For example, a lot of portfolio lenders often tend to be direct lending institutions too. As well as lots of lenders are included in even more than one kind of financing - such as a big financial institution that has both wholesale and retail financing procedures.Home loan Brokers A great location to start is with the distinction in between home mortgage lending institutions and home loan brokers. Home loan lenders are specifically that, the lending institutions that actually make the car loan as well as offer the cash utilized to acquire a residence or re-finance a present home loan. They have particular requirements you need to satisfy in terms of creditworthiness as well as monetary sources in order to certify for a loan, as well as set their mortgage passion rates and other financing terms appropriately.

Our Broker Mortgage Near Me Diaries

What they do is collaborate with multiple loan providers to locate the one that will certainly use you the most effective price as well as terms. When you secure the car loan, you're borrowing from the loan provider, not the broker, that just functions as an agent. Typically, these are wholesale lenders (see listed below) that mark down the rates they supply through brokers compared to what you would certainly obtain if you approached them straight as a retail client.Wholesale and Retail Lenders Wholesale lending institutions are financial institutions or other institutions that do not deal directly with customers, but provide their financings through 3rd parties such as home loan brokers, credit unions, other banks, etc. Typically, these are huge financial institutions that likewise have retail operations that collaborate with customers directly. Lots of huge financial institutions, such as Bank of America and also Wells Fargo, have both wholesale as well as retail procedures.

The Definitive Guide to Mortgage Broker Vs Loan Officer

The essential distinction right here is check my source that, rather than providing fundings through intermediaries, they lend cash to financial institutions or various other mortgage loan providers with which to release their very own finances, on their own terms. The stockroom lending institution is paid back when the home loan lending institution sells the car loan to investors. Mortgage Bankers One more distinction is between portfolio loan providers and home mortgage lenders.

Some Known Details About Broker Mortgage Rates

This makes portfolio lending institutions a good choice for "specific niche" borrowers who do not fit the common lending institution account - probably because they're seeking a jumbo car loan, are thinking about a special property, have actually flawed credit history yet strong financial resources, or may be considering financial investment home. You may pay higher rates for this service, yet not constantly - since profile lending institutions my link often tend to be really cautious who they provide to, their rates are occasionally fairly low.Tough money lenders tend to be personal people with money to lend, though they may be established as company procedures. Rate of interest often tend to be quite high - 12 percent is not unusual - as well as deposits may be 30 percent as well as over. Difficult cash lenders are usually used for temporary loans that are expected to be repaid quickly, such as for investment building, rather than long-lasting amortizing fundings for a home purchase.

Getting The Broker Mortgage Rates To Work

Once again, these terms are not constantly unique, yet rather generally describe kinds of home loan features that different lending institutions may do, in some cases at her response the very same time. Comprehending what each of these does can be a wonderful help in recognizing how the home loan process works and develop a basis for assessing home mortgage offers.I am opened up! This is where the web content goes.

What Does Broker Mortgage Calculator Mean?

Let's dig deeper into this procedure: The very first step to take when acquiring a residence in Australia is to obtain a declaration from the bank you are obtaining from, called pre-approval (please inspect this article to recognize just how the pre-approval jobs in detail). To be able to do that, you first require to locate a financial institution that settles on providing you the cash (mortgage broker meaning).

Not known Incorrect Statements About Broker Mortgage Fees

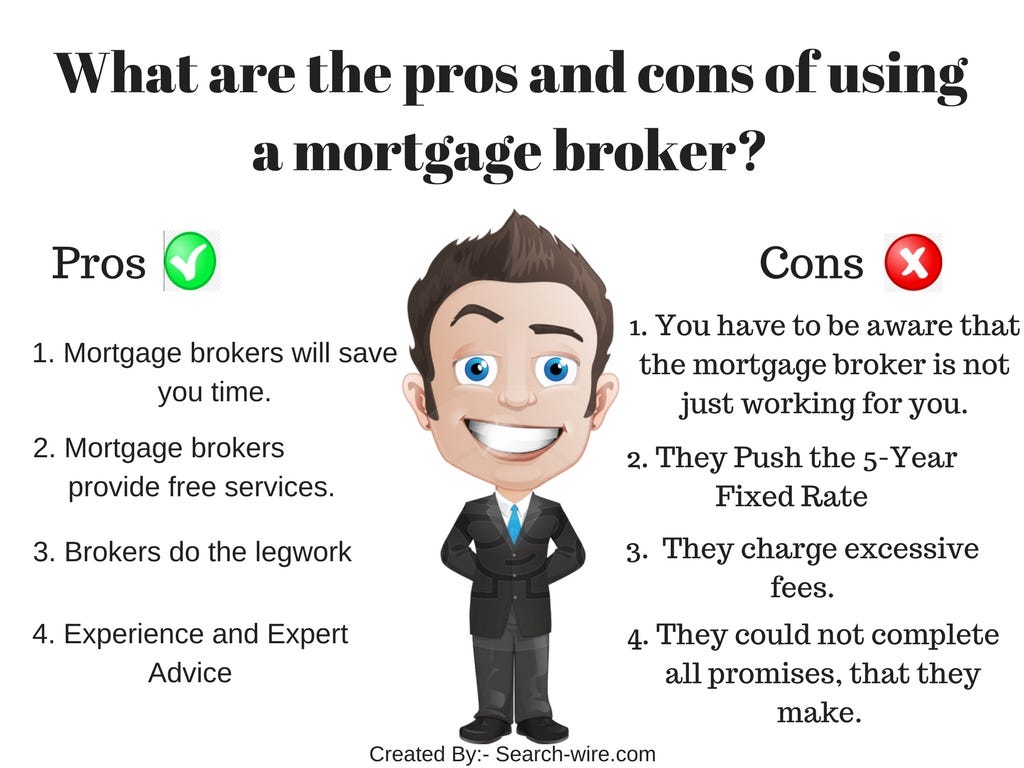

Using a home loan broker gives you several even more choices. Not only when it comes to best car loan deals, but also for conserving time as well as avoiding errors that might obtain your financing rejected.

Report this wiki page